How to Pick a Mutual Fund – Return

I have been pretty successful in picking mutual funds. Most of the funds I have owned over 25 years have outperformed their corresponding indices. I am fortunate to have owned some of the best performing mutual funds during their heyday, including Janus Twenty and T. Rowe Price Capital Appreciation. I have also picked a couple of dogs, but they have been the exceptions.

This is the second in a series of five posts on mutual funds.

Why I Invest in Mutual Funds

How to Pick a Mutual Fund – Return

How to Pick a Mutual Fund – Type

How to Pick a Mutual Fund – Fees

How to Pick a Mutual Fund – Risk

Disclaimer: I’m not an investment professional nor am I licensed to sell securities. This information is provided for entertainment purposes. Before investing, you should seek the advice of an investment professional. I’m not affiliated with nor do I receive compensation from mutual fund companies.

Proven Track Record

I only pick mutual funds from well established fund companies, with a solid track record of high performance. I never pick the hot new funds that burst on to the scene. I only invest with funds that have been around for at least ten years, with the same fund manager. I want to make sure the fund manager has experience in up and down markets. I don’t want someone learning on the job, with my money.

In my experience, if a fund company has good fund managers and a sound investment strategy, they are most likely to produce winning funds in the future. Past performance is not a guarantee of future results. However, experience and discipline are valuable commodities on Wall Street.

Who is more likely to win the next World Series, the Cubs or the Yankees?

Historical Performance

If I don’t believe a mutual fund will outperform its corresponding market index for the next 10 years, I’m not going to invest in it. Since 80% of funds under-perform their market indexes, we can eliminate those right away and concentrate on the funds with superior performance. For a fund to outperform its index it must have a great fund manager and it usually has low fees. Funds with high fees eventually wind up in the under-perform category.

First, I look for funds that have a 10 year return in the double digits. This has become a lot harder to find since the market crash, so you may have to settle for around 8%. If you find high 10 year performance in a fund, check the 1, 3 and 5 year categories to make sure the gains didn’t happen in a short period. Because of the crash, you will see some ugly 3 year performances, but that’s OK. You are looking for consistent performance, not high volatility.

History has a way of repeating itself, as do good fund managers.

Why You Need a High Return

There are two reasons why you need a high return on your investments.

1) Taxes reduce your return, while inflation erodes your principal.

2) With compounding, a few percentage points make a huge difference.

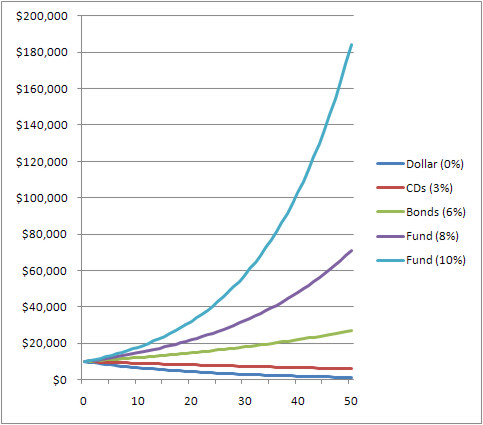

In the example below, I calculated what would happen to $10,000 placed in a retirement account, for someone aged 18. I used 4% for the true rate of inflation and 0% for taxes, since retirement accounts are deferred. $10,000 would be worth just under $1,300 after 50 years of inflation. If placed into a CD or Money Market yielding 3%, it would be worth just over $6,000. If placed in corporate bonds yielding 6%, it would more than double to just under $27,000. If placed in mutual funds averaging 8% and 10%, it would be worth just over $71,000 and $184,000, respectively.

A 2% higher return can almost triple the size of your retirement nest egg.

Saving vs. Investing

Wednesday, I was talking to my daughter’s boyfriend, who just turned 18. He told me he wanted to start saving some money and he asked me where he should put it. First, I told him about mutual funds, instead of going with a savings account. Then, I explained the Rule of 72s, the rate of inflation and compounding. He was quickly lost. When I told him he could earn a lot more money by investing instead of saving, he started to understand.

Savings accounts have their place. They are great for money you may need quickly, such as an emergency fund. They are great for overdraft protection. And, they are great if you will need the money within a short period of time, such as saving for a car. But, they are horrible as a long-term investment.

If a bank pays you less than inflation, you are guaranteed to lose money.

The Bottom Line

The bottom line is that Return is everything when it comes to investing. If you let someone else borrow or manage your money, they will become wealthy, instead of you. If you spend the time to find good investments, you will reap the reward, instead of your bank or broker.

“The four most dangerous words in investing are This Time It’s Different.”

Sir John Templeton – Mutual Fund Pioneer

Great post, Bret.

I love the detail you put into your posts.

As a Canadian, I envy the fact that *nearly* every fund is cheap for you (I mean MERs and other expenses, of course). For us, a 1% MER is cheap… I know you must think that outrageous… but that is the current fact of our economy.

Changing subjects, I have (in the last year or so) invested more money in U.S. companies that I have in any time frame prior. I am curious as to what an American investor thinks about the dollar and investing internationally.

Myke

Thanks Myke,

That’s why I only post once a week. I put a lot of time into thought and research for my posts.

I think the MERs have dropped here in the U.S. I remember in the ’80s and early ’90s that 1% MER was considered cheap. Only Index funds, money markets and those with high minimum balances were lower. It seems that competition has worked in this area.

I am very concerned about the Dollar and have posted about that many times. Right now, the only thing floating the dollar is that other countries are equally over-extended. I think the governments of the world have to get real with their spending. They are burdening businesses and taxpayers to a point where it’s a disincentive to create and produce. And, the social services they are running amount to massive ponzi schemes. It has to stop or it’s going to ruin the global economy.

I like this rationale. One challenge that I have with respect to using this principle for ETFs investing is a lot these funds simply haven’t been out for that long.

Roshawn,

I’ve thought about holding some of my spare cash from my brokerage accounts in ETFs. But, I haven’t spent the time to research their background, stability, etc. With an index fund or ETF, the management isn’t so important. But, the integrity and stability of the company is. I am also not sure how well regulated ETFs are compared to mutual funds.

I still have some homework to do on ETFs. Because of their convenience, I think they will continue to grow in popularity.

If you are comparing apples to apples, I think the data regarding these funds’ performance over the ugly 3 year blood-bath can be very useful.

It would actually tell me more regarding how these managers perform when the going got (gets) tough!

You know that old saying, “Everybody is a genius in a bull market.”

Not so when the bears are on the loose!

Best,

Len

Len Penzo dot Com

Len,

As usual, you zeroed in on the one thing I glossed over in my post. I didn’t want readers scared off by the three year period, because it was bad for everyone.

There’s no question the fund managers that have the best 10 year performance, took the smallest hit during the financial crisis. But, even the best fund managers are going to lose some money when the market tanks by 40%. Anyone completely in a defensive position (Perpetual Bears) probably aren’t going to do well in a recovery. So, it’s too late to jump on their band-wagon.

I’m actually in the process of picking a mutual fund to invest in right now so this post comes in perfect timing!When I decided to invest in a mutual fund, I thought wow! There are just so many options to choose from. So hopefully this will better guide me in the right direction.

I really love to analyze charts as well so likewise I tend to look for companies that have strong establishments as well. Those new and “On the rise” companies tend to be very unstable. Not worth the risk. That’s probably my strategy for any kind of investment.

Mandy,

Thanks for stopping by.

There are a lot of options when choosing a fund and it can be confusing. I have been doing it for so long that it has almost become second nature. Now that I am trying to write it down, I realize that it’s more complex than it should be.

I hope these articles help you.

Bret, I’m enjoying your overview of investing in mutual funds, and I’m looking forward to hearing your views on index vs. actively managed funds in the next installments.

I’m curious, though: are you going to cover other investments, too? Mutual funds aren’t sexy not because they’re stable, but because they really don’t build that much wealth; I know the public sentiment after this recession is slow and responsible saving and investing, but does that mean there isn’t room for investing in real assets and such?

I’d love to hear your thoughts.

Cognoramus,

What I have to say about active vs. index may surprise you. It may be slightly controversial, but I have some reasoning behind it. I will be posting it in the next few days.

I have covered other investments, including some great posts on real estate. The reason I am posting this series on mutual funds is because that is where my experience lies. I have been investing in them for 25 years. I survived Black Monday, the Tech Crash and the Subprime Crisis. I learned some great things from my folks and from newsletters such as Mutual Fund Forecaster and No Load Fund X.

Mutual funds are what I know best. And, this is the most valuable information I have to offer my readers.

Thanks for introducing some common sense into the discussion of how to select good mutual funds.

It is absolutely right that mutual fund investors should be looking at return, risk, and past performance. The key to selecting good funds is to find a way to do all of these things in an integrated way. A new tool called Fundreveal does this by positioning all US mutual funds on a grid representing risk-return versus the S&P 500. It addresses past returns through a “Persistence” rating that rates the frequency that the fund has beaten the S&P on both the risk and return ratings over the last 5 years.

Investors can ry the FundReveal tool for free for up to 200o funds at http://www.fundreveal.com.