Why I Invest in Mutual Funds

About 65% of my portfolio is invested in mutual funds. The rest is invested directly in stocks through my E-Trade brokerage account. Mutual funds were my first and only investment for about 20 years, before I began to choose my own individual stocks. There are a number of key reasons I invest in mutual funds and I strongly recommend them to other investors.

This is the first in a series of five posts on mutual funds.

Why I Invest in Mutual Funds

How to Pick a Mutual Fund – Return

How to Pick a Mutual Fund – Type

How to Pick a Mutual Fund – Fees

How to Pick a Mutual Fund – Risk

Disclaimer: I’m not an investment professional nor am I licensed to sell securities. This information is provided for entertainment purposes. Before investing, you should seek the advice of an investment professional. I’m not affiliated with nor do I receive compensation from mutual fund companies.

Convenience

The beauty of a mutual fund is that it’s almost as convenient as a bank account to open and manage. Although most people are familiar with choosing mutual funds through their 401K plan, opening one on your own is a snap. And, you don’t need a lot of money to start a mutual fund. Many fund companies will waive the minimum balance, as long as you agree to an automatic monthly investment.

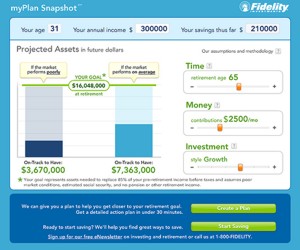

When I first started investing in mutual funds, they didn’t have fully-interactive websites. You had to actually mail in your application with a check and call up customer service to purchase or redeem shares. Now, you can fill out your application online and be up and going within minutes. Plus, you can purchase, redeem or check the value of your shares right online. There are also plenty of incredible financial calculators and research tools.

Disclosure: I’m not affiliated with Fidelity Investments nor do I own any of their products. I’m not affiliated with Rosenfeld Media. The image above represents the many useful tools provided by mutual fund companies.

Security

One huge benefit of mutual funds is that they are very secure. You can lose some value if the market goes down, but no one will have Madoff with your money. 🙂 Funds are audited annually, by large CPA firms, to ensure your money is right where it’s supposed to be. This is not always the case with hedge funds and independent financial advisers. Even banks fail regularly, but mutual funds rarely become insolvent.

Disclosure

Another great benefit of mutual funds is the amount of disclosure that is required by law. You can look up the funds largest investment holdings, the fee structure and the historical performance for various periods. You can learn about the fund manager and the investment objective. You can check out the sector distribution and the turnover rate.

My Dad taught me how to read a prospectus when I was in my twenties. He showed me how they put the pretty charts in the front and hide the fees and expenses in the back. And, he showed me how to interpret the performance of the fund. They now have summary prospectuses that are much easier to read. They are about four pages long and have all the critical information.

Performance

The primary reason to own an investment is to make money. Historically, the stock market has outperformed most other types of investments. Although the market has been very shaky lately, money markets, CDs and government bonds are yielding less than the true rate of inflation. That means you are guaranteed to lose money in those investments. An equity mutual fund is a better vehicle for long-term growth.

My funds have performed much better than my individual stock picks, both in up and down markets. But, I am getting better at picking stocks and I hope to someday rival the pros. Like every small investor, I dream of finding the next Microsoft or Wal-Mart and hitting it big. In the mean time, most of my financial future is securely parked in mutual funds.

Variety

The variety of mutual funds types available today is mind boggling:

| Investment | Stock, bond, real estate, money market |

| Capitalization | Large cap, mid cap, small cap |

| Objective | Growth, value, income, index |

| Region | Domestic, international, global, emerging |

| Sectors | Electronics, finance, medical, media, etc. |

| Allocation | Target date (Retirement) funds |

And, there are combinations, such as Small Cap Emerging Growth.

The Bottom Line

The bottom line is that few investment opportunities have the combination of benefits available through mutual funds. For a small management fee, you can build a solid performing, well-diversified portfolio.

“There’s accountability in the mutual fund industry. And they’ve been tremendous engines of wealth for people and they’re going to continue to be so.”

Jim Cramer – Host of Mad Money

Recommended Reading

Check out Why Invest in Mutual Funds over at FreeFromBroke.com.

This post was featured on the Carnival of Personal Finance over at Budgeting in the Fun Stuff. If you aren’t familiar with the Carnival of Personal Finance, you need to check it out. It’s the premiere carnival for Finance Blogs.

Don’t forget to cover the pitfalls of mutual funds: Sales charges and fees, transfer and redemption fees, high MERs, and additional losses from turnover and taxation. These will all kill your returns, and are common problems with your traditional big bank mutual fund.

Kevin,

I was going to cover this next week when I show how to choose a fund. I will also cover the Index vs. Actively Managed argument. Stay tuned.

Nice! “He showed me how they put the pretty charts in the front and hide the fees and expenses in the back. ”

Yep, and I can say that we have even been caught in those before. You really have to be careful. One thing that has improved today is that with the Internet, it is easier to get information on what to look out for and also what is good.

The Summary Prospectuses are really nice, because the fees are listed on the front page. Nobody cares which Ivy League school the Fund Manager went to, so why read a 50 page prospectus.

This sounds like the beginning of a great investing series. I will definitely check these posts out.

Quick question: What prompted you to begin investing in individual stock?

Roshawn,

That’s a great question. I went to a motivational seminar with two of my brothers. And, one of the speakers was signing people up for a stock picking system. This system was from a company called InvestTools. Since I had always wanted to start a brokerage account and pick stocks, I did.

The system didn’t work that great and I traded sideways in an up market. So, when the subscription was up I switched to a newsletter promoting uranium mining stocks. At first, I killed it and made a lot of money, then the bottom dropped out of this market.

So, it would have definitely benefitted me to stick with mutual funds. But, I am getting much better at picking stocks by using a conservative common sense approach. I have confidence my stock portfolio will do well in the future. But, I don’t recommended individual stocks for most investors. It can become an expensive hobby.

Hi Bret, I was in uranium stocks too, and like you, it was really fun for a while. I saw the top coming and partially got out, but I didn’t think it would stay down so low for so long. I still have one mid-sized producer I kept which I think will do very well over the long term. I believe it must come back due to shortage of supply and huge new Chinese demand in the pipeline.

Jennifer,

Did you subscribe to the Dines Letter?

I wish I had of saw the top coming. I made the mistake of buying more shares, because the first ones had done so well. I am holding them for now, because I think demand for unranium will pick up after the recession eases.

Good article, and I’m looking forward to the rest of it. I too am a fan of mutual funds. For me, it’s index funds which have been a key part of my portfolio. I like the convenience and low fees (and taxes from turnover) associated with such an investment. That said, I have had a couple of actively managed funds that have done fairly well for me in the past. In any event, I’m a fan of mutual funds as a part of the stock portion of asset allocation.

I haven’t invested too much with index funds, for reasons I will describe in my next post. However, I think they are great for someone who doesn’t want to do a lot homeowrk to keep up with actively managed funds. You are also right about the low fees and turnover.

Great series! I think a portfolio made up of mutual and supplemented with some select individual stocks can really grow some wealth (provided you pick good funds and stocks).

Craig,

Thanks a bunch. I agee with you 100%. I am still working on the stock picking part.