Exposing Government Scamflation

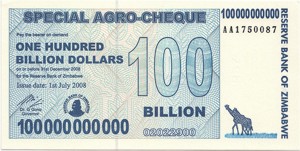

Scamflation (n) – 1. Erosion of our purchasing power by devaluation of the dollar 2. Printing vast amounts of money to cover deficit spending 3. Manipulating the inflation rate to avoid increases in bond interest

Inflation’s Harsh Reality

I read an interesting post over at the OnlineInvestingAI blog, where George reviews a book called How to Profit from the Falling Dollar. And, it got me all upset once again about the state of our economy.

Even though corporations are profiting handsomely from the high productivity (i.e. layoffs), our economy is under attack from the reckless spending by our government. Our national debt now stands near 85% of GDP and unless this changes quickly, we could exceed 100% within a few short years. Then, we will be in the same financial trouble as most of Europe. Below are three of the ways I feel our government is scamming the American public.

Scam 1 – The Shell Game

The scam is very subtle and most Americans aren’t aware of it. Government economists quietly changed the way they calculate the rate of inflation in 2000. In my opinion, this was done to reduce the appearance of inflation. The obvious reason is the interest payable on trillions of dollars of U.S. Treasury bonds. A small percentage increase for these bonds adds up to hundreds of billions of dollars in interest costs per year. Another reason is that automatic increases for entitlements (COLAs) are tied to inflation. That’s why people on Social Security didn’t get a raise in 2009.

What this means to you is that you can expect your standard of living to quietly erode, unless your income and investments are outpacing the true rate of inflation. This is why there are so many working poor and working homeless in America right now. Wages aren’t keeping pace with the real cost of living. And, basic services, such as health care and education, are rapidly outpacing inflation. So, workers are getting squeezed from both ends.

Scam 2 – The Currency Switch

The Federal Reserve is immensely powerful and virtually unaccountable to the American taxpayer. Sure, they testify in front of Congress regularly, but they talk in riddles, while operating in secrecy. I suspect huge sums of money are flowing to banks and financial institutions from our Treasury, when they should be used to fund social programs and infrastructure.

Secrecy never benefits anyone, except those keeping the secrets. In this case, it’s the banks and financial institutions, which have recently proven they cannot be trusted. These are the reasons Andrew Jackson closed the National Bank way back in 1832. Coincidentally, that’s the last time our federal government operated without a deficit. We need a central bank to operate, but it should be open and accountable to the public.

Scam 3 – The Ponzi Scheme

Most of the government entitlement programs, such as Medicare and Social Security, are just big Ponzi schemes. They are paying out benefits as fast as they are collecting the taxes. The reserves for these programs were swindled away to fund the deficit spending. Pensions for government employees are also in trouble and in my opinion the next big crisis. Despite assurances from unions and pension managers like PERS, a number of economists have recently stated these programs are dangerously underfunded.

What this means to you is retirement benefits won’t be able to keep pace with inflation. Workers and employers can expect big increases in payroll taxes, while retirees can expect cuts or freezes in benefits. The retirement age will be raised again to offset the flood of retirees. France just raised their retirement age to 62 today, because they have come to realize their deficits are unsustainable. The Fed is making similar comments about our deficit this week. I expect big changes coming our way, right after the election.

Five Simple Solutions

- The Federal budget must be cut ASAP in order address the deficit.

- We need an immediate independent audit of the Federal Reserve.

- We must have an honest plan to save Social Security and Medicare.

- Pension laws must be strengthened for solvency and transparency.

- Annual benefits for government pensions must be capped at $100K.

The Bottom Line

The bottom line is the government has a lot of sneaky little tricks up their sleeves. We have just witnessed how the last crisis unfolded in 2008. And, if we aren’t careful, the next big crisis may be coming along shortly.

“By a continuing process of inflation, government can confiscate, secretly and unobserved, an important part of the wealth of their citizens.”

John Maynard Keynes – The Father of Modern Macroeconomics

Hi Bret,

Great post. There are at least 3 major ways that the government reduces the CPI and hides inflation.

The first (and silliest) way is that the government and press draws attention to the “core CPI”. Conveniently, this number excludes food and energy, the two things that we cannot live without!

The second is in the way that the housing component is generated. Instead of using the prices of houses (or mortgage payments), they use the average rent of a comparable house. So what happens? During the housing bubble, housing prices went up, but rents went down. So, the cost of housing in the CPI went down as housing prices went up!

The third way is in the method that the government calculates productivity increases. If a computer is twice as powerful as the previous year’s model, then the government says that it is twice as productive. Therefore, the relative cost has dropped by half. This is clearly untrue, because even if a computer is twice as powerful it does not radically increase the amount of work that we can do with it.

Here’s a link to the most popular alternative measures of government indicators: http://www.shadowstats.com/ .

Thanks for the link!

George

George,

Thanks for filling in the technical details for everyone.

When I think about the real cost of living in my lifetime, it seems like inflation averages about 4-5%. I was around back in the ’70s to see 20% mortgages, Nixon’s price freeze and the oil embargo. And, I don’t buy the 1-2% inflation rates being posted by the BLS.

The government definitely has a better handle on inflation, since Volker stepped in to run the Fed. But, they do a much better job of camouflaging inflation than in controlling it. Hopefully, our deficits will never get to a point where we return to the high inflation rates of the past.

Bret

The Shadow Stats website is awesome. It pegs the inflation and unemployment rates about where I figured they were. It’s no big newsflash that politicians are dishonest. What’s amazing to me is how many people believe them.

@Bret: I basically agree with everything you say here. Seniors would be getting Social Security checks twice as big as they are now if Clinton and Bush hadn’t messed with the inflation numbers. The Fed is pushing us over the cliff to hyperinflation with their money printing. I think the central bank duties should be folded back into Treasury so the people have some control/insight over monetary policy. Last time I checked, the unfunded liabilities were over $108 trillion (not a typo). Sadly, governments around the world see the riots in Greece and decide it’s easier to let the next generation solve things rather than try austerity.

@George: Love the shout out to John Williams at Shadow Stats. He’s doing great work.

Jennifer,

Not only do politicans lack the political will to tackle the budget deficit, I often wonder if most citizens understand the scope of the problem. As long as the government is allowed to deceive everyone, this won’t likely change. Unfortunately, it may take a crisis before anyone starts to take action. I certainly hope not.

Hi Bret, I think you’re right that most citizens don’t really comprehend how bad the problem is. I read an excellent book on this subject about 5 years ago called “The Coming Generational Storm: What You Need to Know about America’s Economic Future.” I tried to get friends and family to read it but I heard a lot of “too scary” and “that won’t be my problem for a few decades.” I think when you get to numbers this big, it’s hard for people to truly understand them.

PS- I linked to this from my Facebook page.