Debt – World’s Biggest Product

This is the third post in my new Pillars of Personal Finance series.

- Saving – The Bank of You

- Investing – Grow Your Wealth

- Debt – World’s Biggest Product

- Income – Your Personal Economy

- Planning – Goals, Budget & More

World’s Biggest Product

I read somewhere recently Debt has now become the world’s biggest product. Even just a couple of generations ago, debt was relatively rare. Sure, people took out mortgages to buy houses, but they paid for most other things with cash. I remember my parents buying a brand new Honda in the 70s with a check and I don’t believe they had any credit cards, until sometime around the 80s. Bills were paid by check and other transactions were settled with cash. Things have really changed in the past 40 years. Cars, college, meals, medical procedures and even cell phones are bought on credit now. This is by design, because debt is very profitable and a reliable source of income for banks and others. Often, the debt is more profitable to the seller, than the product it financed. That’s why every store is now pushing you to sign up for their credit card.

Good & Bad Debt

One debate that will never be settled is the discussion of Good vs Bad Debt. Debt that finances a valuable asset, such as a home or an education, is considered by most to be Good Debt. High interest consumer debt, is considered Bad Debt. Somewhere in between is debt to finance a car, home improvements, etc. Some will argue all debt is bad. Others will say at 4% interest, you should never pay off your house. I’m fiscally conservative, so I drove beater cars and paid off my mortgage early. You must decide how much debt is Good or Bad and how much you will allow in your life. One thing I can say for certain, every dollar paid in interest is a dollar that could be put to better use.

Debt Trap

I’ve done a lot of very wise things with my finances, but managing debt wasn’t one of them. For decades, I struggled to pay off consumer debt. As the head of a single income household, it always seemed like the needs outweighed the paycheck. The car would break, the major appliances died or there were the Christmas and vacation hangovers. I was struggling to keep up and debt just seemed to keep piling on. Debt mounts quickly and it takes forever to pay off, because it is compounding against you. The high interest steals most of the payments and the cycle continues.

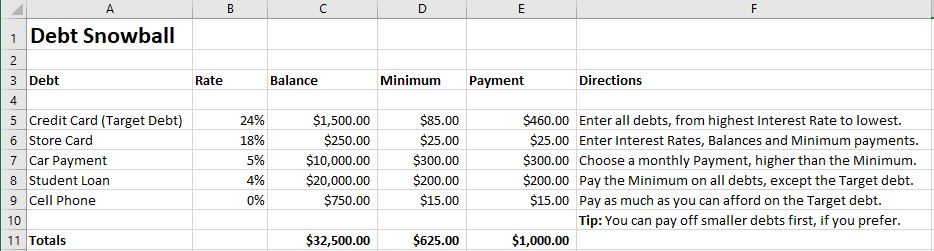

Debt Snowball

If you are struggling with debt, I know exactly how you feel. One of the things that helped me finally eliminate consumer debt was the Debt Snowball. Eliminating debt is a systematic process and you are in control. You may be paying minimum payments on a lot of debts and it goes nowhere. The magic of the Debt Snowball is that you focus on eliminating one debt at a time. As debts are eliminated, the Snowball picks up speed and momentum. More and more of your money goes to principle, instead of interest and years are cut off your payments.

You can use an online Debt Snowball Calculator or you can use a piece of paper. I used an Excel spreadsheet, which you are welcome to download below. It doesn’t matter how you do it. What matters is that you get started now and stick with it. It may take years to eliminate your debts, but you will see progress. There will be windfalls and setbacks, so don’t get upset or discouraged. Just commit to the process and Keep Going.

There is no wrong way to execute a Debt Snowball. Some people prefer to pay off small debts first. This gives you some quick Wins and also eliminates those payments. In the example above, I would pay off the Store Card in the first month, just to get rid of it. Some debts have fixed payments, like car loans and cell phones, so it’s hard to pay extra on them. Just pick another target debt, like the Student Loan, and clobber it.

Keys to Success

- Stop buying things on credit.

- Commit to a monthly amount that will realistically pay off your debt.

- Envision each debt as a Target to be eliminated.

- Pay any windfalls to the Target debt. (bonus, tax refund, etc.)

- Avoid over-limit and late penalties, At All Costs.

The Bottom Line

Debt is a parasite that consumes your future income and opportunities. If your income drops, debt becomes a mortal enemy. Avoid high interest consumer debt at all costs and manage “Good Debt” wisely.

“Every time you borrow money, you’re robbing your future self.”

– Nathan Morris