Walmart Credit Card Quotas

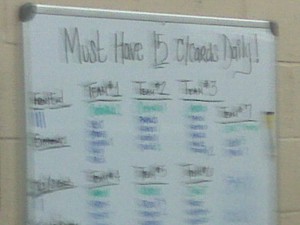

Last year, I posted about the high interest rates for Walmart credit cards and the way cashiers pester shoppers to open a Walmart credit card, every time they check out. This weekend, as I was saying “No” to a Walmart credit card for the hundredth time, I noticed a quota board behind the head cashier. It appears each cashier in the San Clemente store “Must Have 15 C/Cards Daily!”

Revolving Debtors are the Target

There is an ongoing debate of whether credit card companies are preying on consumers or people in debt are just irresponsible. It’s my opinion both are true. Companies are directly targeting their customers with credit offers, to help sell more merchandise and bring interest revenue to the bottom line. They are definitely aware that a large percentage of the population is indebted and financially vulnerable. In fact, these are the customers they are targeting. Let’s face it; customers who avoid impulse purchases and pay off their credit balance each month aren’t nearly as profitable. Nor are they as likely to sign up for a new card, since they probably have other credit cards with a zero balance.

Are you a victim or a contributor to debt accumulation?

How Badly do you Want It?

The $1,000 question is: do you need that $799 flat screen enough to pay 22.9% interest? If so, you may be the kind of customer Walmart is looking for. By the way, I’m not just picking on Walmart. There are plenty of other retailers engaged in the same lucrative practice. And, there seems to be no shortage of customers willing to pay steep interest rates to avoid waiting.

This example comes from someone I know and love. Two weeks ago, he complained about being in debt and the interest rates on his credit cards. Then, he mentioned how I really needed to upgrade my TV. And, he recommended the exact Samsung model he had just bought for $799 at Walmart. It was a great deal. Of course, that didn’t include his new entertainment furniture, Blu Ray player and cable service upgrade.

How much extra are you willing to pay to have it now?

How Much are you Willing to Give?

I’m in the middle of reading the classic personal finance book Your Money or Your Life. The primary theme of the book is that everyone should consider how much each purchase costs in life energy. In other words, how much of your precious time and energy do you have to give up to pay for an item? Was it a fair exchange? Or, did you pay too much? Money comes and goes in our lives, but time is a precious commodity. Once you have squandered your time and life energy, you can never get it back.

Would you work 100 hours for a new TV, if you couldn’t use credit?

Is it Worth the Risk and Stress?

In my opinion, the biggest downside to being in debt is the dramatic increase in financial risk. Every small payment becomes a huge liability, if your income drops. And, the higher your debt-to-income ratio, the higher your chances of becoming bankrupt or homeless. Easy credit can become a hard liability. Millions of people figured this out during the mortgage crisis after they lost their homes. Millions of others have lost their jobs and are struggling to pay their debts. The risk and stress are rarely worth the purchases.

How much risk are you willing to take in your financial life?

The Moral of the Story

This is usually the section where I toss in some nuggets of wisdom and highlight the moral of the story. But, there is no right or wrong answer here, only an important decision. Do you pay more for having something now? Or, do you wait until later and pay less for the same or better item? Do you pay down debt and contribute to savings? Or, do you upgrade to the hottest new gadget or drive the latest model car?

I have been plenty foolish with credit and I have paid for it dearly. I warn anyone who will listen to avoid getting into debt. Most people have to make their own mistakes, before they realize what a slippery slope credit is. Like any tool, credit can be useful. But, you can also smash your thumb or lose an eye, if you aren’t careful.

The Bottom Line

The bottom line is that credit is the siren’s song of a desperate retailer. And it’s beautiful music to the ears of a debtor. The surest way to keep your ship afloat and safely off the rocks, is to avoid the enchanting lure of credit.

“I had plastic surgery last week. I cut up my credit cards.”

Henny Youngman – King of the One Liners

Recommended Reading

Watson Inc. – Labeling Debt to Make it More Palatable

Money Walks – 7 Stupid Things We do with Credit Card

Free from Broke – Is it a Good Idea for the Credit Market to Ease?

There is a show on, Princess, where the host makes these women calculate the ‘life energy’ as an exercise. Would I work 100 hours for a TV? that’s like a little over two weeks so sure!! these exercises are a bit dangerous in that ppl don’t consider how much of their life energy is devoted to just covering fixed expenses, taxes, debt etc… Out of 1 month of working days, a person might have only the last 2? 3? days where they can earn disposable income. (i’m guessing on the days)

now maybe i would have to work 8 months, add up all my “disposable income” working days before i finally had enough for that TV. i think that would knock more sense into ppl…

Zud,

It’s an interesting concept and I didn’t think about it much, before I read the book. In my 20s and 30s it seemed like all I ever did was work. And, when I wasn’t working, I was doing side-gigs, attending college or doing homework.

Now that I’m in my 40s, I’m a lot more defensive of my free time. I don’t let others volunteer my time or generate comittments for me. I stopped taking side-gigs and I avoid joining organizations.

After 30 years of hard work, I feel like I need some time for myself.

That’s why we’ve waited to buy our TV. We finally spotted a good deal on what is not a super-fancy TV but what looks to be a good one, and may go for that.

I already have the TV I want picked out. I want the LG 55″ LED with Internet Apps. The funny thing is that I have been waiting for a couple of years or else I would already have paid $2,200 for a Sharp Aquos 52″ LCD.

Right now, I’m saving up for the TV. I’m about four months away from buying it with cash. By then, I’m hoping the price will have dropped or the model will have improved.

Hi Bret, I definitely feel companies like Walmart can be predatory. I remember reading about Providian (bought later by WaMu) that openly preyed on consumers. They preferred people who recently exited bankruptcy because they had a taste for credit and couldn’t declare bankruptcy again for years. They did all kinds of bad things, like shredding checks to charge bogus late fees, and charging for services customers never asked for.

On the other hand, I agree that people can be irresponsible. They want to have the same gadgets as their neighbors even if they can’t afford them.

I’ve never read that book “Your Money or Your Life” but I definitely calculate how much time the purchase will cost me before I make it. I have very little debt (not even a mortgage) and I think very carefully before adding more.

Jennifer,

One of the great things about the Dodd-Frank reform is the new consumer protection agency. Elizabeth Warren was chosen to run it and I’m certain she will do a great job. Somebody needed to put an end to these dirty tricks and scams. It went on for way too long.

I enjoyed reading YMOYL, but I already knew most of the concepts in the book. Plus, it recommends tracking every penny, which isn’t going to happen for me.

The real take home from the book is to save and invest until your passive income exceeds your expenses. Then, you are Financially Independent.

The problem with the book is that it’s dated (even the revised edition I read), so the concepts don’t work as well as they once did. For example, investing in CDs and treasuries isn’t going to provide much income. And, their equations don’t include inflation, which is a huge issue right now. Still, it’s worth a read.

Wow, I had never thought about companies having credit card quota’s – glad you snapped a pic of that board at Wal-mart.

I think tightening up the credit approvals would help the most but would essentially put the card companies out of business. People that don’t need credit would get approved and people that might “need” it wouldn’t.

Maybe what really needs to happen is to limit the ability to use credit cards on frivolous items like TV’s and other extras. Maybe only let it be used for educational items, business expenses, more like a loan that just swipe it for a soda and candy bar at the convenient store. Of of implementation would be a nightmare! But hey our government never cared about that before. Just look at the IRS! Just some thoughts.

Thanks for sharing,

-Keith

Keith,

The quota board is still up and they ask me every time I check out at Walmart. I noticed they lowered it about a foot, to make it less obvious. Also, I was in AAA yesterday to register my truck and they asked me if I wanted a AAA credit card. Unfortunately, this problem is spreading. I wonder if AAA has a quota?