How Large Corporations Skirt Taxes

Last week, I posted that many large multi-national corporations aren’t paying their fair share of income taxes. I have posted about this problem before and I believe it’s getting worse. Although America has some of the highest corporate income tax rates in the world, the amount some large corporations actually pay is embarrassingly small.

Here are some facts and figures.

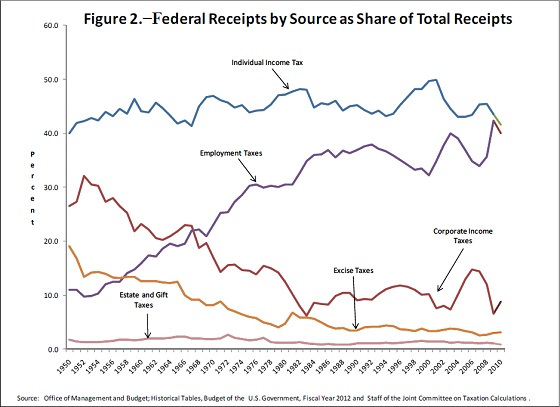

Corporate Tax Receipts have Plummeted

As you can see from the chart above, the percentage of Federal tax receipts paid by corporations has dropped from nearly 30% in the 1950s to around 8% today. Considering how much revenue large corporations bring in and the amount of infrastructure they use in the course of business, it’s obvious they aren’t paying their fair share. Instead, they have steadily shifted the tax burden onto employees and small business owners.

Here is how it is being done.

Corporate Tax Schemes

Special Tax Credits – Most taxpayers have no idea there are special tax credits only available to large corporations. Some of these credits are so narrowly defined that they can only be taken by one or a few companies. They are published so deep within the massive tax code that no one else even realizes they exist. These special tax credits are arranged by a corporation’s lobbyists and the politicians they support with campaign financing. These credits are one of the reasons why General Electric was able to make billions of dollars in profit and pay zero federal income taxes in 2010.

International Profit Shuffle – Large multi-national companies shuffle profits to the countries with the lowest income tax rates. Since, the U.S. has some of the highest rates, overseas profits are left offshore and transferred through foreign subsidiaries to lower tax areas, such as countries in the Caribbean. Apple alone has $74 billion sitting in foreign accounts. At the current 35% corporate tax rate, that is almost $26 billion in lost tax revenue for the U.S. That is just from one company. Many other companies are considerably more aggressive in tax avoidance than Apple.

Source: Associated Press

Private Banking – According to a report from the Tax Justice Network, there is between $21 and 32 trillion dollars in overseas accounts, costing the world’s governments $280 billion in lost tax revenue. The report claims there is a virtual (pirate) banking system that allows the super-wealthy to shift their wealth through the 50 largest banks, investment banks, insurance companies, hedge funds and money managers. Conservative analysts, such as Dan Mitchell from the Cato Institute, believe these estimates are high and the assumptions faulty. I agree the numbers could be overblown, but even a fraction of this amount equals a lot of lost tax revenue.

Source: CNBC

There are many more tax schemes, but I think everyone gets the idea.

My Tax Solutions

These income tax loopholes may sound complex and difficult to correct. However, I have some very simple solutions that could be implemented easily within the existing tax code. They wouldn’t require any new taxes or collection agencies. They wouldn’t place any new compliance burden or require any heavy new tax or accounting requirements for businesses. In fact, it’s as easy as 1,2,3.

Here is how it can be done.

1. Alternative Corporate Tax – If you are an American who earns a high income, you are subjected to the Alternative Minimum Tax. This rule forces individuals to pay a minimum amount of taxes, no matter how many credits and deductions they have. It’s not a perfect system, but it does allow the government to collect a fair amount of taxes from wealthy individuals. Unfortunately, there is no alternative minimum tax rate for corporations, which allows them to weasel out of paying their fair share. An ACT would counter-act most of the tax schemes listed above and it could be implemented for the 2013 tax year.

2. Capital Gains Increase – The tax rate on long-term capital gains is at an amazingly low 15%, which allows corporations and the super wealthy to pay a much lower tax rate for investments than for earned income. I am a huge believer in investors and investments, but the LTCG rate is way too low. Even Warren Buffett has championed raising the rate. I believe the LTCG rate should be raised to 20% for the 2013 tax year. The new 20% rate wouldn’t close down any businesses, kill jobs or hurt the economy. It wouldn’t penalize retirees or small businesses. It would still reward investors who take risks and grow our economy. But, it would collect a fairer percentage of taxes on investments, compared to earned income.

3. Zero is the Minimum – The only thing more ridiculous than GE making billions of dollars in 2010 and paying zero federal income tax, is that they initially received a$3.2 billion tax benefit. GE now claims they will pay some income taxes for 2010, instead of taking the credit. Zero should be the minimum any corporation or individual should pay in income taxes. To collect high taxes from millions of hard-working Americans, then give tax credits or refunds to others who paid zero is outrageous. It is corrupt and unfair. It is a redistribution of wealth from the middle-class to the idle and the ultra-rich. The minimum tax liability should be zero and not a penny less.

The Bottom Line

The bottom line is that it’s insanely unfair for the President to be calling for higher taxes from the Americans who already pay the most, while large corporations are allowed to make billions in profit and pay very little. It makes a lot more sense to make everyone pay their fair share across the board, including corporations.

“There may be liberty and justice for all, but there are tax breaks only for some.”

Martin A. Sullivan – Contributing Editor of Tax.com

Recommended Reading

Len Penzo – Those Given Everything Appreciate Nothing

Bruce Bucks – Long Term Savings is not Cool

Don’t Quit your Day Job – Mortgage Interest Deduction Usage by Tax Bracket

This post was featured on the Carnival of Personal Finance over at My Personal Finance Journey. If you aren’t familiar with the Carnival of Personal Finance, you need to check it out. It’s the best place on the web to get your financial advice.

Hand in hand with simplifying the tax code, might not hurt to take away some of those regulations that favor very large corporations. For example, onerous reporting rules for publicly listed companies can be easily borne by a GE or AAPL or such, who can afford legal departments and legions of accountants. Much costlier for micro-caps. Many small companies now opt out of the public market, denying them a source of funds that could drive business expansion and employment.

I am on-the-fence about reducing some of the reporting requirements for public companies, such as Sarbanes-Oxley. On the one hand, compliance is ridiculously burdensome, especially for smaller cap companies. On the other hand, it seemed like every public company had their own definition of earnings prior to SOX. As long as companies play games with earnings, taxes and off-balance sheet entities, something like SOX will be necessary to protect investors and standardize reporting.

I’m glad that corporations pay little in taxes. If they did, they would just pass it onto the consumer in the form of higher prices.

Thanks for stopping by Squeezer.

Unfortunately, the trend towards lower taxes doesn’t seem to yield lower prices for consumers. Instead, corporations are raking in record profits and sitting on huge piles of cash.