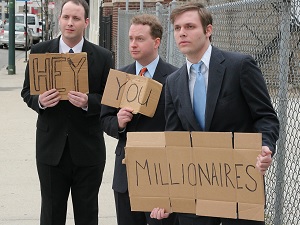

Become a Millionaire in One Easy Step

I read an article today that discussed the status of the world’s growing number of millionaires. This article shared a very enlightening statistic.

Millionaires invest on average 20% of their income.*

*Source: Yahoo Finance

Investing is the Key to Success

So, it’s pretty much as simple as that. If you invest a good part of your income, then within a number of decades you will likely become a millionaire.

Call me Captain Obvious, but “Everybody Knows That”. The only question is, why aren’t people doing it?

Obviously, I have over-simplified the process of investing and accumulating wealth quite a bit. I wanted to just concentrate on one simple facet of the entire process. I want to understand why people fail to invest. This has confused me for the 30 years I have been investing. One reason I started this blog in 2007 was to encourage people to get started investing, yet it seems like a fool’s errand.

36% of people in the U.S. have nothing saved for retirement.*

*Source: BankRate.com

Feedback is Requested

If you are one of the people who reads my blog and you don’t invest, I would love to hear the reasons why. You can leave an anonymous comment, if you don’t want to be identified. I am searching for creative ways to encourage new investors.

If you don’t currently invest, what is keeping you from doing it?

The Bottom Line

The bottom line is that investing is the most common way to become a millionaire in America. That’s why there aren’t any posts about clipping coupons or making soap on my blog. We need the magic of compounding in order to prosper.

“How many millionaires do you know who have become wealthy by investing in savings accounts? I rest my case.”

– Robert G. Allen

Recommended Reading

101 Centavos – Long-term Investing versus the Quick Buck

Don’t Quit your Day Job – What Type of Investors Perform Best?

Squirrelers – The Snowball Effect of Money

I have investments through retirement accounts, but not in any taxable investment accounts. I know that is an overdue step but it feels there are a lot of barriers to getting started – setting up an account, making decisions about what to invest in, concerns about the tax implications, etc.

I have taxable and retirement accounts and recommend both for most people. If you get laid off or need money for an emergency, you don’t want to get hit with all of the taxes and penalties from cashing in a retirement account. Same thing if you are saving for a house.

Getting started is super-easy. Just go online to Vanguard, T-Rowe Price or other reputable mutual fund company and sign up. I have T-Rowe funds and you can get started with no minimum, just by signing up for the $100 per month AIM. If you don’t know which fund to pick, start with an S&P 500 index fund. You can always move it later.

Taxes aren’t a big deal, until you take money out of the fund. You will just have a small dividend and capital gains liability each year.

I forgot to mention, make sure any mutual fund you sign up for is pure no load, with no 12b-1 and low management fees.

I wrote a whole series on picking mutual funds that you can read, if you want to know more.

How to Pick Mutual Funds – Fees

Click link above.