Top 10 Ways We know Inflation is Bad

The Dow dropped 100 points today on Friday the 13th. The speculated causes were the high inflation numbers and the economic woes in Europe reminded everyone that deficit spending can’t go on forever. The dollar strengthened and commodity prices fell. But, it was little consolation to nervous investors.

The Affects of Inflation on Consumers

According to the Labor Department, the Consumer Price Index (CPI) rose 0.4% in April and 3.2% in the past year. This is the biggest year-over-year increase since October of 2008. However, it is well known the CPI has been modified to understate inflation. The website ShadowStats.com uses the 1990 CPI, which calculates inflation above 6% and rising quickly.

The Federal Reserve is playing a dangerous game by manipulating the interest rates, especially while they are easing. The new CPI may allow the Fed to claim inflation is under control, but consumers know better. Prices of critical staples, such as food and gasoline are putting a strain on family budgets and crowding out spending for other items.

My Top 10 List

10. The Dollar is so low Parker Brothers is considering replacing the currency in the Monopoly game with Chinese Won.

9. Toilet paper has become so expensive that the Sears catalog is making a comeback.

8. Gold and other precious metals have soared to dizzying new highs. Unfortunately, they are barely keeping pace with inflation.

7. Medical costs are so high aromatherapy is now considered an elective procedure.

6. Billionaire hedge fund manager Raj Rajaratnam has been found guilty of insider trading that netted over $63 million in illegal gains. He claims he was just trying to pay off his student loans.

5. Groceries have become so expensive it’s hard for many families to put food on the table. The Chief Economist’s response, “Let them eat iPads”.

4. Congress is scrambling to raise the debt ceiling, so the government can continue to operate. Unfortunately, Goldman Sachs refuses to approve the new credit limit.

3. The U.S. Mint is having trouble printing money fast enough to cover the deficits. So, they have engaged Groupon to help the government cut back on spending.

2. Reality TV shows are struggling with payroll, so they started voting off the Idol contestants with talent. Survivor has slashed their wardrobe costs by making contestants appear in their underwear.

1. Gas prices are so high it costs more to fill the tank than to buy an SUV. In other news, three refineries have closed down due to mysterious fires.

The Bottom Line

The bottom line is that inflation is no joke. It’s the government’s sneaky little way of stealing from everyone who owns a dollar. When it comes to investing in assets, I recommend keeping it real.

“If Americans ever allow banks to control the issue of their currency, first by inflation and then by deflation, the banks will deprive the people of all property until their children will wake up homeless.”

Thomas Jefferson – 3rd President of the United States

Recommended Reading

Len Penzo – 9 Everyday Items More Expensive than Gasoline

Wealth Informatics – Apps to Save Money on Gas

TradeTechSports – 10 Dividend Stocks that Protect Against Inflation

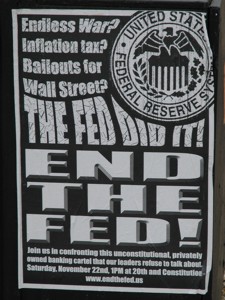

You know what, Bret? You speak the truth here. But the funny thing is this is really no joke at all (no pun intended). If the Fed decides to implement QE3 this June, that will be one more nail in the dollar’s coffin, and the only beneficiaries will continue to be the bankers and market traders who will ride the wave of a rising stock market (that will be worth less in real-dollar terms anyway because of the continued devaluation of the buck that will result from the ongoing money-printing campaign).

The Fed needs to be abolished NOW and the people need to take their government back from those who continue to steal from the US Treasury, so that our standard of living can eventually be saved (if only somewhat).

All the best,

Len

Len Penzo dot Com

Len,

Most of these jokes are based on real news stories or recent events. The toilet paper joke was inspired by my shopping for a house that has three bathrooms. Oh, I did make up the Groupon thing. But it’s based on the recent attempts by Congress at spending cuts, which are a sham.

I believe the Fed is going to have a hard time getting QE3 through. Already they are making appearances and telling people inflations isn’t that bad. That’s where the iPad comment came from. I even saw a news article yesterday where they are claiming inflation has peaked and they pointed to the dropping oil prices. As you and I both know, they are full of mullarkey. When QE2 ends, Treasury bonds are going to drop like a rock and everyone knows it.

As for banning the Fed, I’m a big fan. At the very least, their books should be wide open so the public can understand what they are up to. It will be interstesting to see how much traction Ron Paul will get, because that is one of his key issues. At the very least, he will be talking about it a lot on the campaign trail.

Bret

I don’t place much faith in the official CPI numbers either — how can their fudged stats tell me how much I am actually spending on food & transportation? Inflation is personal and real, and “official CPI” is nothing more than a farce.

Also with inflation, what is happening isn’t so much that the pie is getting smaller as that the pie is getting redistributed. Who’s eating off the excess if people are losing purchasing power?

There is no question a redistribution of wealth occurring and most of the middle class doesn’t see it happening. That’s why I thought the quote from Thomas Jefferson was so timely. I didn’t even realize they used the term homeless back then.

This is my favorite post of the day!!! You beat out Letterman’s top 10!! You have real comedic talent 🙂 with a big grain of truth!

Thanks Barbara,

I had a lot of fun writing this post. I’m thinking maybe the intro was a little too dry though.

Hahaha, I love it! Especially #4! You know who is the puppet master.

Also, #5…. what is UP with such MASSIVE consumption of Apple products? I love em, but wow… America, don’t complain about not having enough money if you are spending out the wazoo on things you don’t need.

Best, Sam

Sam,

#5 came from the recent road-show by the Fed. The Chief Economist was trying to convince everyone that inflation was under control. As an expample he was telling everyone how the iPad 2 cost the same as the original iPad. One of the people in the audience stood up and said “I can’t eat an iPad.” I thought it was pretty funny.

You are right about people spending way too much money on gadgets, Apple or otherwise. I know people who buy new $400 phones every six months. Then, they spend a fortune on accessories that become worthless when they buy a new phone. It’s crazy to me.

Hi Bret, the US government has been playing games with the CPI so long, it’s lost credibility. People who read PF blogs like yours know that wages are not keeping up with the cost of basics. I did get a kick out of your list although I thought #2 was already true. 😉 I will stick with silver over USD any day because silver has increased 8 fold in 10 years.

Jennifer,

Didn’t silver drop 30% last week? Ouch!

I believe other precious metals may be a better investment, based on their limited quantites and industrial uses. But, you are way more knowledgeable in this area than me. I have never been a big fan of precious metals and I sure missed the boat on this run-up. I will have to re-think that strategy in the future.

Hi Bret, silver did have a serious correction, but I was expecting that. It almost tripled in the last year, after all. All markets have corrections, like the Dow last week. 🙂

I don’t believe silver is done. It still hasn’t hit the nominal all time high from 1980. Of course, $50 in 1980 is a lot more money today due to inflation.

Hi Bret, The Shadow Statistics inflation number is much closer to reality–that is for anyone who lives in the real world! 3.2% in the past year (govt number) is a bad joke. But joke or not, the whole world accepts it.

The governments happy face number is a double edged sword. We’re constrained by it on the income side (raises, Social Security increases, interest income, etc) but the real number (Shadow Stats) is what we have to pay for everything.

Kevin,

I have always used an annual inflation rate of 5% in my fiancial planning, since before I had even heard of Shadow Stats. It was obvious to me the BLS’s inflation rate was a joke a long time ago.

The government has really painted themselves into a corner. Between the trillions they owe in bonds and the millions of people living on entitlements, they can’t afford to publish the true rate of inflation. I just wish they would stop the deficit spending, so the dollar would actually be worth something.

I love it! Especially the toilet paper one. Whenever I try to explain inflation to someone I actually like to use toilet paper as an example and encourage people to invest in paper products. One thing is for sure, people will always pinch a penny to buy a roll of Charmin!

Betsy,

I have three bathrooms and it is expensive trying to keep them all full. I used to be able to get a good deal on TP at Wal-Mart, but not any more.

I looked at some paper company stocks last month, but I wimped out. I remember some of them going bankrupt a couple of years ago and I don’t want to lose my investment. I owned GM and Fannie Mae, so I’m still a little gun-shy.

Inflation is termite.

It is a very nice and interesting topic.I like top 10 list and the best one was toilet paper.Thanks for sharing!