Breaking the Cycle of Being Broke

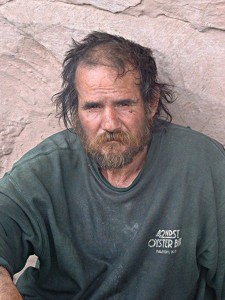

I got a Facebook message from a friend of mine who was feeling down. His truck was broken and he didn’t have the money to fix it. He told me that he was just tired of being broke and he couldn’t get motivated to work, even though he really needed the money. I remember that feeling very well. I also remember when I finally discovered how to stop being broke. It was surprisingly easy.

The Problems

Vicious Cycle – The problem with being broke is that it becomes a vicious cycle. The collection calls, late fees and penalties just pile onto the already difficult job of paying the bills. Loans, payments and items purchased on credit siphon away your paycheck, which makes it hard to afford basics like food, rent and utilities. The debt begins to grow and you can never get ahead.

Scarcity Mindset – The only thing worse than actually being broke is worrying about being broke. The more you think about bills and payments, the less energy you spend on increasing your income. How hard would it be to pay your bills if you made twice as much money? It’s often easier to increase your income than it is to reduce expenses.

Loss of Motivation – Being broke kind of wears on people. It undermines their confidence and distracts them from the critical job of earning income. When all of your income goes to bills and you are still broke, it’s hard to get motivated. Yet, that is exactly what you need to do in order to break the cycle and get ahead.

The Solution

1. Manage Income – One common trait among people with financial problems is they rarely balance their bank accounts. They often have no idea how much money is in their checking account, until they get hit with an avalanche of overdrafts. The first step in getting ahead is managing what you have. With bill pay and online banking, there is no excuse for frequently paying bills late or overdrawing your account. If you don’t wake up in the morning and know approximately how much money is in your bank account, you aren’t paying attention to your finances.

2. Learn to Save – The second step is a critical one. If you don’t save some portion of your paycheck, you will always be broke. You will never get ahead and have financial security. The saddest thing I see are good people who have worked hard their entire lives and have nothing to show for it. They may have earned millions of dollars in their careers and let it all slip through their fingers. Learning to save is the best thing you can possibly do for yourself and your family. Having money saved brings security, opportunity and peace of mind. Living paycheck-to-paycheck brings stress, risk and worries.

Check Out: Pay Yourself First

3. Make a Budget- Another common trait among people with financial problems is they rarely budget. I’m not saying you have to add up receipts or put money in envelopes, but you will need a basic budget for how much money gets spent on rent, utilities, food and entertainment. Otherwise, it’s like playing whack-a-mole with your paycheck and the important things may not get paid. Managing your spending is just as important as managing your income.

4. Have a Plan – Once you start to put some money away, you will need to know what to do with it. Creating a financial plan is probably the easiest of these four steps. For now, all you have to do is pick a good investment and start putting money in. Later, you will need to come up with a plan that makes sense for you.

Check Out: Three-Step Financial Plan

The Bottom Line

The bottom line is that it’s much easier to balance your accounts and manage your money than it is to deal with all of the headaches from being broke. There is no shortcut to sound finances and no income is big enough to spend foolishly. You must take control of your finances or your finances will control you.

“Being broke is a temporary situation. Being poor is a state of mind.”

Mike Todd – American Film Producer

Recommended Reading

Financial Samurai – How to Become a Millionaire by Age 30

Wealth Informatics – How to Start a Business with Little or No Money

Watson Inc. – How to Buy Happiness

You’re right Bret, once the downward spiral is in motion–often sparked by a layoff, health challenge, or extraordinary expense–it’s tough to reverse it. Interest begins piling up and the bills get even harder to pay. I suggest a Debt Management Plan to folks who find themselves in this kind of fix, the best option for most people most of the time, once the crisis is resolved, in my opinion. It’s a lot better than bankruptcy!

I completely agree with the value of a debt management plan and the ability to get back on track with a little professional help. I also believe there are many people who could easily turn things around just by paying a little closer attention. Most of the people I know who are struggling don’t really have a master plan for their finances. They just want to spend all of their money and not have to manage it. A little discipline would help a lot.

I’ve definitely had my ups and downs with my finances. I work online and i tend to do really well for short periods and then struggle for longer periods.

I’ve learned that i’ve got to save and be frugal when i’m making the most money, to be prepared for any tough times that might be ahead.

I plan on investing in some offline businesses, in order to stabilize my income.

If you are making money online cheers to you. It has been my dream for many years, but I make most of my money working my 8to5 job.

This is really sound advice. Some of the people I know to always be in dire straits never cared much for their money and don’t do anything to solve their issues, but complain. I faced some hard times myself and, until I really cut down on my spending and started having a better mindset, it didn’t work out. The moment I started being more responsible, it all started falling into place

Thanks for stopping by Dojo.

It’s amazing how fast things start to turn around when a person takes responsibility for their own future. Counting on others is certain to lead to disappointment.

Its funny when one is broke even productivity takes a hit! Instead of working harder I find myself bored, all I want to do is sleep and escape the facts that I have debts to repay and food to put on the table.

With time though am learning little by little to keep saving, small savings but at least now I don’t worry so much about being broke…my meagre e-fund can push me through the tough times and certainly keep me motivated and productive.

You are so right Simon.

Being broke is demotivating, even depressing. Worry is definitely the enemy of action, so it leads to more money problems. I am glad you have discovered this, because it isn’t always obvious at the time. It took me quite a while to figure it out.