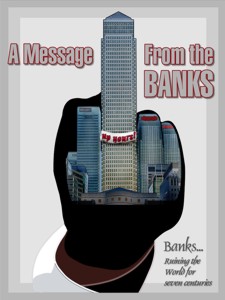

10 Reasons why Banks Must be Closely Regulated

I’m a pretty laissez-faire kind of guy and I believe in a free-market economy. I don’t believe in government red tape choking the life out of business. But, I do believe banks must be firmly regulated for their own good and the good of our country. It’s the right thing to do for Wall Street and for Main Street. Here are 10 reasons why.

1. History of Economic Failure

If you have ever studied American history one thing is perfectly clear. Most economic problems for the past two hundred years were caused by banks and speculators. From the bank panics of the 1800s to the Great Depression, banks have contributed to economic hardship for millions of hard-working Americans. After the great depression, sound banking reforms, such as the Glass-Steagall Act, ensured economic stability and prosperity for over 70 years. Unfortunately, these reforms were quietly gutted in a bi-partisan effort, which lead to the financial collapse of 2008. Some of these reforms were restored under the Dodd-Frank law of 2010. But, they haven’t been fully implemented and regulated. Banks are still ignoring and undermining these reforms, which means we are all still at risk for future economic problems.

2. JP Morgan Chase Lost $2 Billion

Just in case you haven’t seen the financial news lately, JP Morgan Chase bank may have lost 2 billion dollars on some extremely complex hedges. It’s unclear even to management and regulators how much money was lost or how they lost it. But, it has something to do with credit default swaps. If you don’t know what a credit default swap is, it’s the financial instrument that caused AIG to lose $100 billion dollars during the financial crisis of 2008. Of course, the taxpayers of America were kind enough to bail out AIG and Goldman Sachs for 100% of every dollar they lost. The funny thing is that Jamie Dimon, the CEO of JP Morgan Chase, has been railing against all of the new “unnecessary” banking regulations at the same time his bank was hedging with these dangerous derivatives.

3. U.S. has Exposure in Europe

There is a reason the U.S. stock market tumbles every time bad news comes out of Europe. Investment banks and hedge funds know the U.S. has huge exposure to the banks and currencies in Europe, while most taxpayers have no idea. The Fed and Treasury both recently testified the European crisis was “contained”, but this is similar to the statements they released about investment banks, right before Bear Stearns went bankrupt. During the financial crisis of 2008, the Fed lent $16 trillion in emergency funds, $3 trillion of which went to foreign banks. Since the Fed has no transparency, Americans have no idea what type of monetary guarantees or exposure we have to European nations and currencies. EU nations can’t be kicked out of the union for being reckless and insolvent. That equals a blank check and the debtor nations have figured this out. If Spain, Italy, Portugal and Ireland follow Greece into insolvency, America could be drug down with the EU.

4. Derivatives are too Risky

There are some legitimate business reasons to sell commodity futures. There are legitimate reasons to hedge positions. But many of the new derivatives and instruments are so complex and dangerous, they should be made illegal. And, they should only be traded on regulated exchanges, never over-the-counter in private. The continuous fallout from credit default swaps, Collateralized Debt Objects (CDOs) and synthetic CDOs highlight the need shut down the gambling by financial institutions. These instruments are so complex it often takes months to figure out how much was lost and where the money went. The risk is way too high and their business purpose is dubious.

5. Extreme Leverage is Legal

Back when I took economics in college, I was taught banks could lend $10 for every $1 in deposits. Now, because of over-the-counter derivatives and other synthetic instruments, it’s obvious banks, hedge funds and other financial institutions are using much higher leverage to maximize profits. One example is the recent collapse of MF Global, where $1.6 billion of its customer’s deposits went missing. Estimates of MF Global’s leverage ratio were around 40:1 at the time of their bankruptcy. According to Forbes, their leverage ratio was 80:1 back in 2007. This much risk and leverage should be illegal.

6. The Fed is Unaccountable

Most Americans believe the Federal Reserve is a government agency, accountable to Congress and the President. This is not true whatsoever. The Federal Reserve is an independent central bank, who is mostly accountable to member banks. Although they testify regularly in front of Congress, they are self-funded and virtually unaccountable to voters or the government. They have become increasingly secretive and uncooperative, while trillions of treasury dollars flow around the world.

7. Money is Practically Free

Another thing I learned in college Economics is that banks never wanted to borrow at the Discount Window of the Fed, because they didn’t want anyone to know they were having liquidity problems. Since the Fed no longer discloses who is borrowing money or how much they are borrowing, it’s a virtually unlimited source of money for banks. Many of these are foreign banks who are borrowing our money at near zero interests rates. Yet, taxpayers don’t seem to have the right to know who our money is being lent to.

8. Too Big to Obey the Law

Big banks have vigorously resisted consumer and financial reforms, before and after they were passed. They stifled loan modifications and used robo-signers to illegally foreclose on homeowners. They re-ordered transactions in order to collect billions in overdraft fees from customers. Basically, they act as though the law doesn’t apply to them. Who can blame them, since they rarely receive anything more than a slap on the wrist. Until bank executives are sent to jail for breaking the law, they will continue to do it.

9. Lobbying is Unlimited

Ever since the Supreme Court struck down campaign finance limits as a violation of free speech, the amount of special interest money going to candidates has exploded. The overwhelming majority of contributions from the banks are going to Mitt Romney. They are upset with President Obama for his banking reforms and hope to have most of them overturned after the next election. Until reasonable reforms and limits are placed on campaign finance, voters will never have a voice that equals the deep-pockets of special interests.

10. Bailouts are Inevitable

For all of the tough talk coming from politicians in an election year, there is virtually no chance they won’t support the banking agenda in times of a crisis. Most of the key political posts in the Fed and Treasury are held by bankers, with strong ties to the banking community. Congress and the President will likely fold again, under the pressure of a financial collapse. The only way to avoid future bailouts is to establish solid regulations that keep banks from taking extreme risks.

The Bottom Line

The bottom line is that banks can’t be trusted to regulate themselves and there are no free market forces to contain them. Bankers and traders receive massive bonuses for taking extreme risks, which are borne by the depositors and taxpayers.

As the nation’s central bank, the Federal Reserve derives its authority from the U.S. Congress. It is considered an independent central bank because its decisions do not have to be ratified by the President or anyone else in the executive or legislative branch of government, it does not receive funding appropriated by Congress, and the terms of the members of the Board of Governors span multiple presidential and congressional terms.

Source: FederalReserve.gov

Recommended Reading

Invest it Wisely – Getting Screwed out of your Hard Earned Capital

Len Penzo – Personal Finance for Dummies

The Biz of Life – WMDs Discovered at JP Morgan

This post was featured on the Carnival of Personal Finance over at James Petzke. If you aren’t familiar with the Carnival of Personal Finance, you need to check it out. It’s the best place on the web to get your financial advice.

Yes, in some cases, unfettered capitalism is just too dangerous. Some “fettering” is probably necessary to preclude meltdowns and the like, as well as prevent corruption. As our politicians seem always to be reactive not proactive, I fear little will change until after we’re all sucked into a financial catastrophe not of our own making.

I hope we can avoid another catastrophe. Very little was done after the last one to prevent the next.

I hope this JP Morgan Chase issue stirs the pot for banks. At the very least, it will be difficult for them to keep saying they don’t need to be regulated.

On the current economic system the banks always win, just as at a casino the house always wins.

Welcome Good Trader,

I was optimistic for a while, because of the new banking regulations. But, I suspect many of these will be gutted after the next election.

That is a sad fact. I remember a friend who said that the best way to avoid those economic problems is by adapting a gold standard. However, that forces discipline, so most countries don’t like it.

I hope that the same can be applied with banks.

Hi Joshua,

One one hand, I like how the price of gold shows how much central bankers are really inflating our currencies. Government economists routinely lie about inflation, but the high price of gold makes this obvious.

On the other hand, the total value of all the gold in the world isn’t nearly enough to represent all of the global economies. So, there isn’t any practical way to return to a gold standard. Those days are long gone.

I wouldn’t want a gold standard myself, and personally I believe it’s a bad idea. I prefer gold remain free, to be chosen freely by the people. The only standard should be that which people choose on their own free will. Instead of a gold standard, just eliminate all the penalties on holding gold today, such as capital gains, sales tax, etc…

I believe in unfettered free markets coupled with strong and fair laws to keep people on an even playing field. Most “problems” with the free market are problems due to central control of money, crony capitalism, corruption, and loss of rights. I agree that these are all bads and some regulation is needed, but oftentimes, it’s better to change the intervention that’s causing the problem in the first place.

I guess the real problem is that our economic system is rather warped with all the subsidies, regulations and virtual monopolies, so it’s like playing with a big stack of cards. You need more regulations to fix the problems caused by the previous batch. When this happens in software, we eventually throw out the system and build it from scratch. Can we do that with our onerous body of laws and regulations?

P.S. Thank you for the inclusion! 🙂

Any time Kevin.

My opinion is the biggest hurdle to a fair enforcement and regulations is campaign finance reform.

Lobbyists are very successful in getting loopholes and exclusions inserted into bills, which creates the unfair playing field. That’s why laws are now thousands of pages long. The new unlimited campaign financing will only make things worse.